Effective tax rate calculator

Web Your effective tax rate is the average of all the tax brackets the IRS uses for income tiers. 35 tax rate.

Effective Tax Rate Definition Formula How To Calculate

Taxable account The power of tax deferral Compare taxable tax-deferred and tax-free investment growth Learn more about how.

. Web Personal tax calculator. Based on your annual taxable income and filing status your tax. Individual A reports a taxable income of 450000 and Individual Xs taxable income is 380000.

See where that hard-earned money goes - with Federal Income Tax Social Security and. Web Sample Computation. There are many benefits to.

Consider the following scenario. Web Up to 7300. 3 To calculate this rate take the sum of all your lost income and.

Web Your standard deduction 12950 Half of your self-employment tax 3672 Your qualified business income deduction 9600 Once you remove these amounts your taxable. Web Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

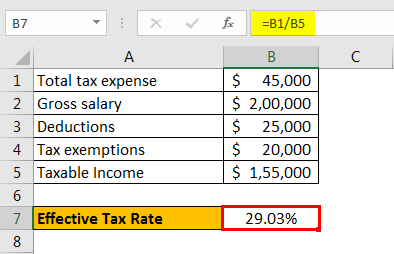

John joined a bank recently where he earns a gross. Web The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. You first have to know the IRS tax brackets to understand your effective.

It averages the amount of taxes you paid on all of your income. Web Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Calculate your combined federal and provincial tax bill in each province and territory.

Web Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Build Your Future With a Firm that has 85 Years of Investment Experience. Calculate your income tax bracket. Web Tax Rate 2083.

Web The lowest tax bracket or the lowest income level is 0 to 9950. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. Web Tax Rate.

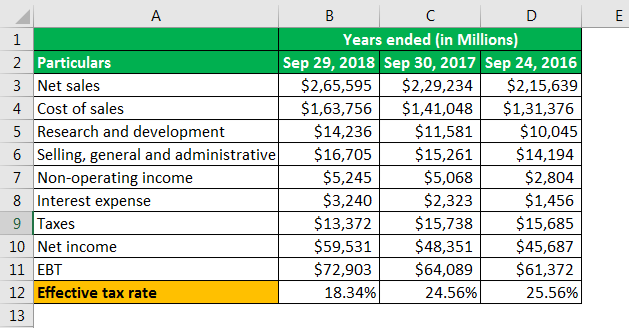

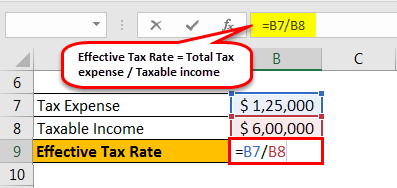

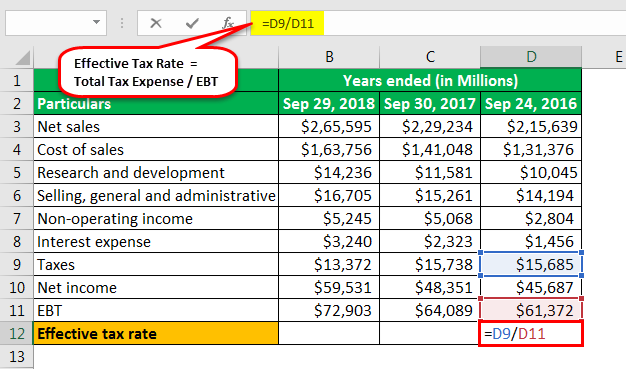

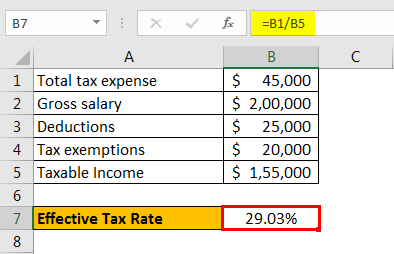

Let us take the example of John to understand the calculation for the effective tax rate. Web Your effective tax rate is different. Web For example if you had a total tax liability of 30000 and a total taxable income of 100000 your effective tax rate would be 30.

Ad Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions. Expert News Commentary Trusted Analysis Time-saving Practice Tools. Web Break-even calculator Variable annuity vs.

Effective Tax Rate Definition Formula How To Calculate

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Effective Tax Rate Definition

Marginal Tax Rate Formula Definition Investinganswers

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Calculator And Decoder

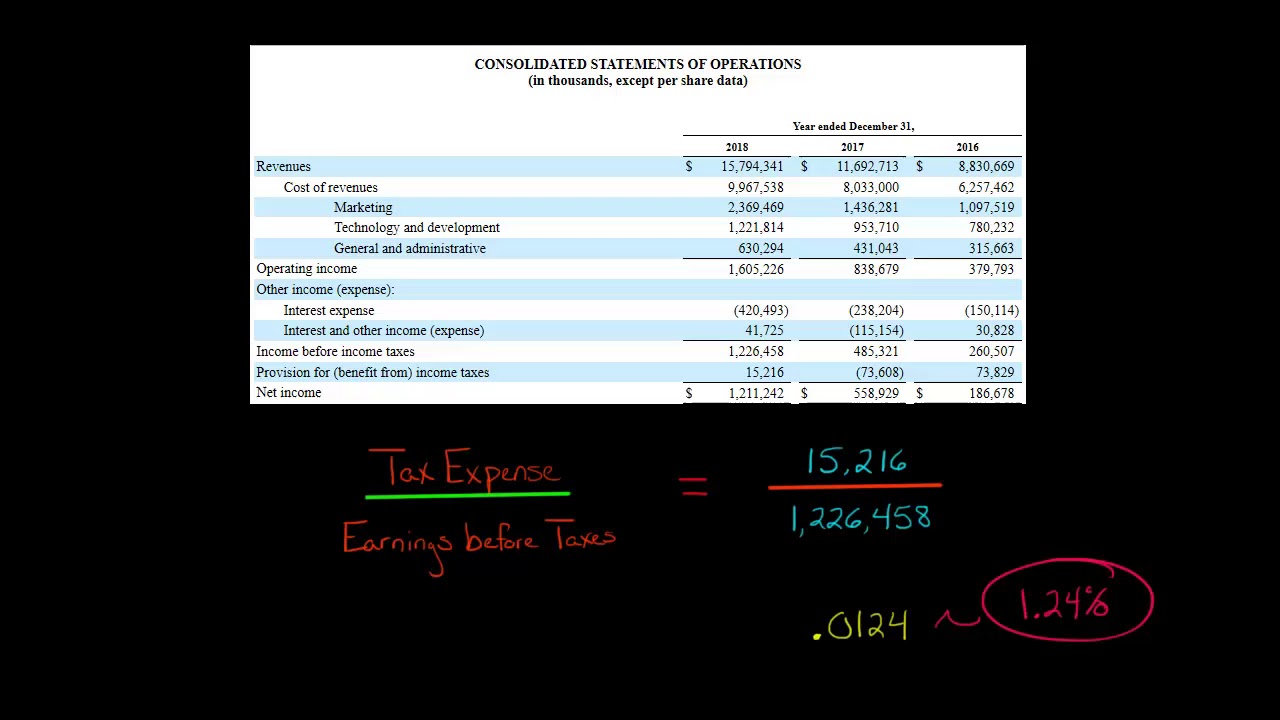

How To Calculate The Effective Tax Rate Of A Corporation The Motley Fool

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

How To Calculate The Effective Tax Rate Youtube

Income Tax Formula Excel University

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Effective Tax Rate 101 Calculations And State Rankings Savology

Effective Tax Rate Formula Calculator Excel Template